When choosing tractor insurance, match your farm's needs to specific coverage plans. Consider tractor type, age, use, location, and add-ons like rental services. Location impacts premiums, with rural areas offering lower rates than urban regions. Tailor policies for niche tractors, like fuel-efficient models, to manage costs. Evaluate tractor capabilities and potential hazards for relevant coverage options. Research reputable insurers known for robust policies and excellent service. Compare premiums, assess coverage breadth, and review maintenance tips videos before deciding.

Looking to buy a tractor? Don’t forget insurance! Protect your investment with the right tractor insurance plan. This comprehensive guide helps you navigate the process, from understanding your needs to selecting the best coverage. We’ll break down key factors influencing plans, different types of coverage available, and expert tips for choosing the perfect fit for your tractor—ensuring peace of mind on the farm or job site.

- Understanding Tractor Insurance Needs

- Factors Affecting Tractor Insurance Plans

- Types of Tractor Insurance Coverage

- How to Select the Best Tractors Insurance Plan

Understanding Tractor Insurance Needs

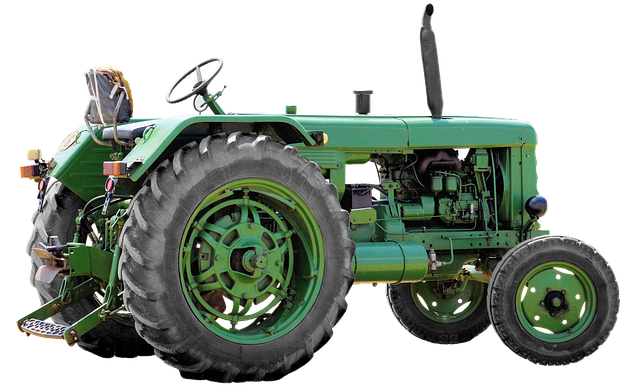

When considering tractor insurance plans, it’s crucial to first understand your specific needs. Different farmers and landowners have varying requirements based on their operations’ scale and nature. For instance, a small-scale farmer with a standard model might require basic coverage for regular field work, while an extensive operation with high-performance tractors designed for large fields necessitates more comprehensive protection.

Selecting the right tractor is a critical first step in this process. Specialist tractor dealers online offer a wide range of options, from compact models suitable for smaller farms to robust, high-performance machines for extensive agricultural operations. Understanding how to choose a tractor that aligns with your farm’s needs will ensure you acquire insurance plans tailored to cover potential risks, from mechanical failures to accidents on the vast landscapes your tractors traverse.

Factors Affecting Tractor Insurance Plans

Several factors influence tractor insurance plans, and understanding these variables can help farmers and enthusiasts make informed decisions when purchasing coverage. One key aspect is the type and age of the tractor. Older tractors might be more affordable to insure due to their reduced market value, but they may also come with higher repair costs and lower safety features compared to modern models. When considering a select tractors for insurance, it’s essential to evaluate its intended use; whether it’s for farming, construction, or recreational purposes, as this impact the level of risk associated with the vehicle.

Additionally, location plays a significant role in tractor insurance. Rural areas might offer lower premiums due to fewer accidents and less dense traffic, while urban regions could have higher rates because of increased exposure to theft, vandalism, and busy roads. Another consideration is the inclusion of add-ons like tractor rental services nationwide or specific coverage for electric or hybrid tractors, which can significantly impact the overall cost. A fuel-efficient tractors comparison might also be relevant when assessing insurance needs, as certain companies cater to these niche preferences with tailored policies.

Types of Tractor Insurance Coverage

When considering tractor insurance plans, understanding the various coverage options is key. The type of tractor you own, its intended use, and the unique risks associated with your operation will dictate which policies are most relevant. For instance, if you’re looking for a best tractor for vineyards or planning to operate in rough, rugged terrain, you’ll need comprehensive coverage that accounts for these specific needs.

Similarly, if you’re on the market for selecting tractors suitable for a small farm, your insurance should reflect the diverse tasks these machines may perform. This might include everything from routine field work and crop cultivation to specialized operations like clearing land or pulling heavy loads. By evaluating your select tractors‘ capabilities and potential hazards, you can tailor your insurance coverage to offer peace of mind and protection against unforeseen circumstances.

How to Select the Best Tractors Insurance Plan

When selecting the best tractor insurance plan, it’s essential to consider a few key factors. Firstly, evaluate your specific farming needs and the type of land you operate on. Different types of tractors are designed for diverse tasks, from plowing fields to hauling heavy loads. Understanding your operational requirements will help in identifying the appropriate coverage levels needed for each scenario.

Additionally, research reputable insurance providers known for their robust policies and excellent customer service. These companies often offer tailored plans that cater to farmers’ unique needs. Explore options, compare premiums, and assess the breadth of coverage provided. Remember to review tractor maintenance tips videos for proactive care, which can also influence insurance considerations in terms of preventive measures and potential cost savings. Choose a plan that aligns with your budget while ensuring comprehensive protection for your valuable investment among reputable tractor dealers nationwide.

When choosing the right tractor insurance plan, it’s essential to consider your specific needs and the unique factors that influence coverage. By understanding the types of protection available and evaluating your risks, you can select a policy that best suits your farm or agricultural business. Remember, the ideal plan is one that offers comprehensive coverage at a price that aligns with your budget, ensuring peace of mind while you continue to operate and maintain your valuable tractors. So, take the time to evaluate, compare, and ultimately, Select Tractors insurance that provides the protection your investment deserves.